GST Rates

Setting up Tax for the things your sell or hire.

When you charge for things like, site fees, extra adults, extras sales items, power, gas, water etc. The charged values are entered or calculated at the Inclusive Tax rate or amount. Tax may, or may not form part of the amount of charge, depending on the tax code set for the item you are selling.

The Tax Codes must be defined first using the GST Rates file, then the tax code is selected for the item you are selling.

As items you sell are usually predefined in UniRes, the tax code for the item you are selling is set in the File Maintenance file for the particular item.

To illustrate...

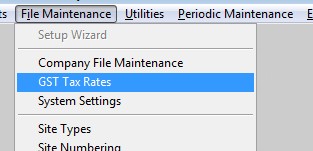

Have a look at the GST Rates File (The Global definition of Tax). You will see three types of tax codes predefined. GST, CONS and NON. Select from the Menu Bar - File Maintenance - GST Tax Rates.

See: Menu Bar - File Maintenance - GST Tax Rates

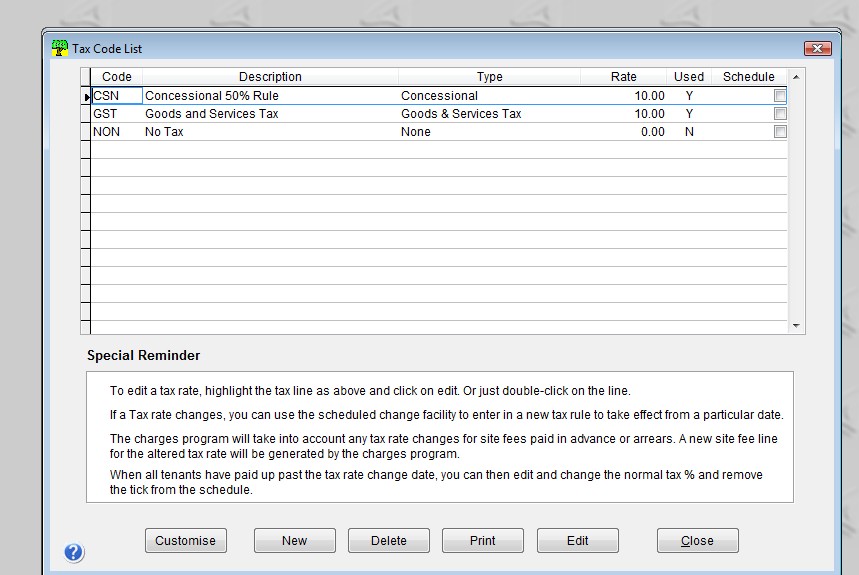

The following screen opens...

You can see there are three types of tax, pre set for you. The tax coding is flexible so you can give any tax type any type of code, but the Tax Type is a Tax Method eg. Concessional, Goods & Services Tax or None.

Concession Tax Method

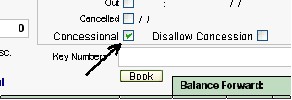

This type of tax is a special tax method. If an item being sold is setup with tis tax code, UniRes will check to see if the Concession Flag (tick box) is set in the booking account and if set, will calculate the tax at the percentage you specify for concessional tax, otherwise the calculated tax will be the normal GSt tax percentage.

The above sample screen shot shows where to look for the Concessional Flag in the Booking Account.

Goods & Service Tax Method

This tax type just applies the tax percentage you specify for GST and disregards the Concessional Flag (tick box) setting in the Booking account.

NON

No Tax is calculated.

Where to set the Tax Codes and UniRes Settings that affect tax

Most of the tax codes are set in the File Maintenance programs used to set up UniRes.

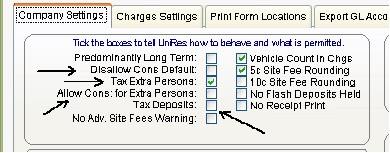

The File Maintenance - System Access ...

See: Menu Bar - File Maintenance - System Access

The Tick boxes control how UniRes behaves.

Disallow Cons by Default: If ticked, all booking accounts will never automatically be set to a Concessional status after a tenant has paid up site fees for over 27 days (night) stays. If left unticked, UniRes will automatically flag the booking as being entitled to receive concessional tax. The actual tax setting for the charge determines if the concessional factor is taken into consideration for the booking. So even if the booking has the concessional flag set, the concessional tax will never be applied, if the tax type for the sold item is set to GST (ie. not set to CSN).

Site Fees are the exception, as site fees tax is ruled by the status of the concessional tax flag and the Disallow Concession flags in the booking account as well as the Tax Type chosen for the Site Rate (see next paragraph).

You may find the explanation a bit confusing at first, but when you start using UniRes, the method works very well when in actual use.

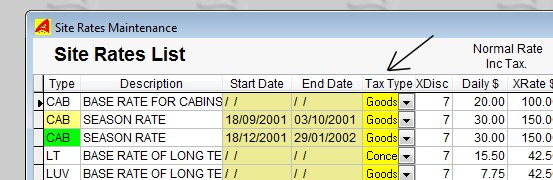

Menu Bar - File Maintenance - Site Rates

Select the Tax Type for each site fee rate.

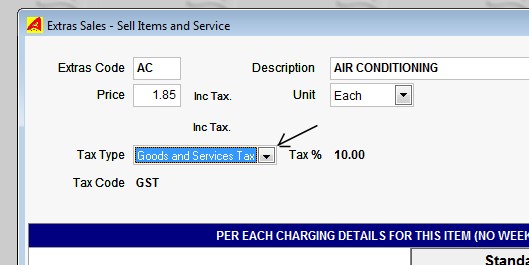

Menu Bar - File Maintenance - Extras

Extra items you sell can each be set to a tax type.

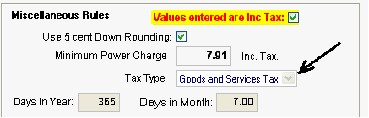

Menu Bar - File Maintenance - Power Table - Miscellaneous Rules area.

The Power charge Tariff can be set to a tax type.

Created with the Personal Edition of HelpNDoc: Easy Qt Help documentation editor