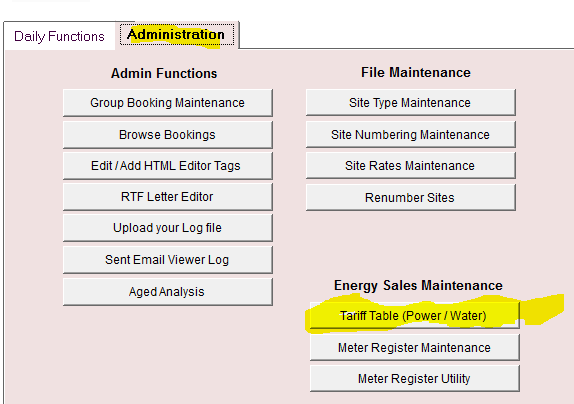

To set the charge rates for electricy meters and water meters, select from the Command Centre - Administration TAB.

Select Tariff Table

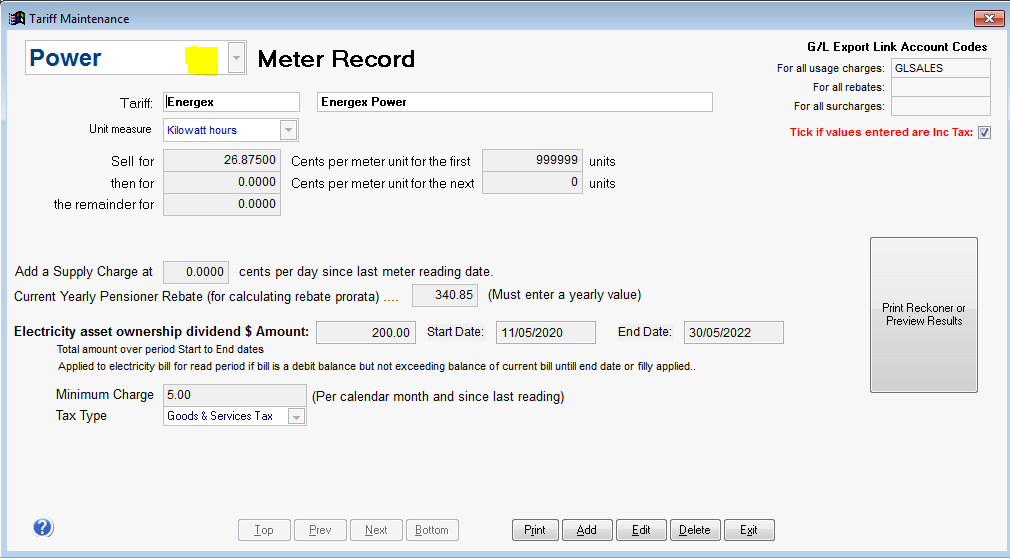

Next you'll see the Table file, ready for adding, editing or deleting various Power and Water (if appliicable) sales rates etc.

Input Fields...

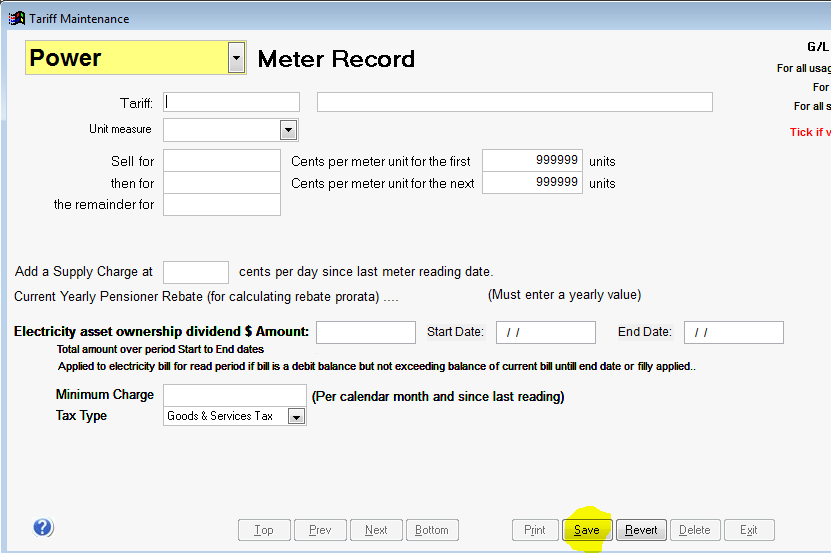

(Click on Edit, to change an existing record, Add, to add a new Tariff type record, or Delete to delete a Tariff.) Once you have finished, select Save to save your changes.

Inputs..

Meter Record : Select from the list, Power or Water.

Tariff : Enter a short meaningful code for the tariff.. eg.. AGLPower

Description : Enter a description to the right of the tariff code.

Unit Measure : Select the appropriate unit measure (kW/h for power, kl for water.

Price breaks : Single or progressive charge per unit of measure, where appropriate (varies according to energy supplier.)

Note: the prices ar usually in cents per unit eg. 100.9 is $ 1.09 per unit. Water is usualy in larger values.

Units field 1,2, and remainder. eg. x amount for the first 500 units, y amount for the next 1000 etc.

Most suppliers use a single rate these days.

Supply charge : This is calculated on a daily usage basis and is calculated from the last reading date to the present date, or the period in days. Usually set by taking the yearly supply charge and dividing the value by 365 (or the number of days in the year).

Note the supply charge is also in cents per day.

It is important to make sure the last reading date is accurate! for the Meter Record attached to the booking.

Current Yearly Pensioner Rebate : If you subsidise the pensioner rebate to your clients and the government, enter the yearly rebate maximum. The rebate will be applied to their electricy account. The clients pensioner number must be saveed in the booking extended booking detail for the rebate to be applied. This is not the same as the "Electricity Asset rebate or extended rebate for hardship relief."

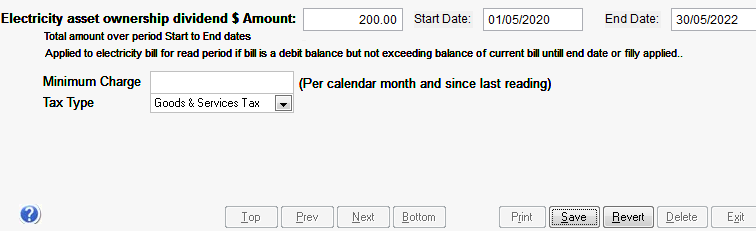

"Electricity Asset rebate or extended rebate for hardship relief" is a fixed $ amount that the Government gives to elligable pensioners or permanent residents in your park.

It started in Queensland in 2018 as a $50 grant for 1 year , to be applied gradually as a cred to outstanding electricity balance, but only until the Maximum is not exceeded to the individual tenants.

(As at this date of writing, the EAOR is now referred to as a "Hardship, or Special Rebate", so same principal but different politics!)

Enter the Dividend amount (eg.$200 for year 2020 ...) and the progressive electricity charges are reduced until the $amout is fully allocated.

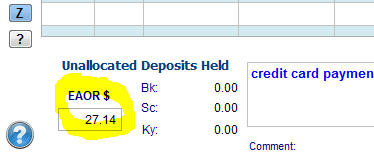

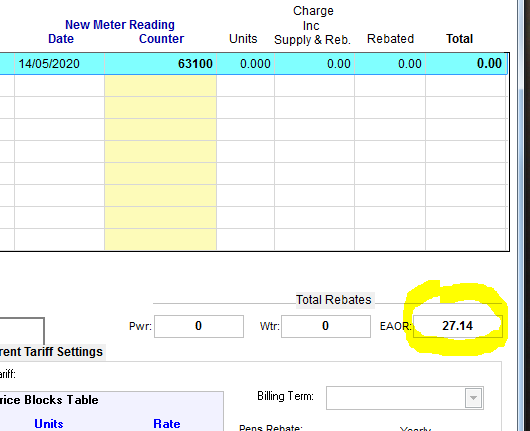

The EAODTotal (amount applied to date) is shown on the lower left of the booking account screen and in the Electricity posting screen.

Adjusting the Total EAOR postings field on the account screens.

Note: The total can be adjusted if necessary as rebates may have been given before recording using UniRes etc. Just enter the correct total to date and the posting will keep adding to the total if rebate is applicable.

Also note that the UniRes power journal entry screen does not calcutate or apply the "Special Rebate". You have to use the 'P' for power charge code key in the charges screen and the Utility Charges window to enter the meter reading.

A future update may include the facility into the power journal entry screen.

EAOR applied to date. Shown in Electricity posting screen. Must be zeroed on start of new rebate grant. Just enter a 0.00 and press enter.

The EAod amount will only be applied between the date specified. When the period of over, the Eaod total should be reset to zero in the booking Eaodtotal register BEFORE any new allocation period is setup in the Tariff Table.

The Power Journal for postings will also calculate EAOR Rebates as required.

_____________________________________________________________________________________________________________

Created with the Personal Edition of HelpNDoc: Produce electronic books easily