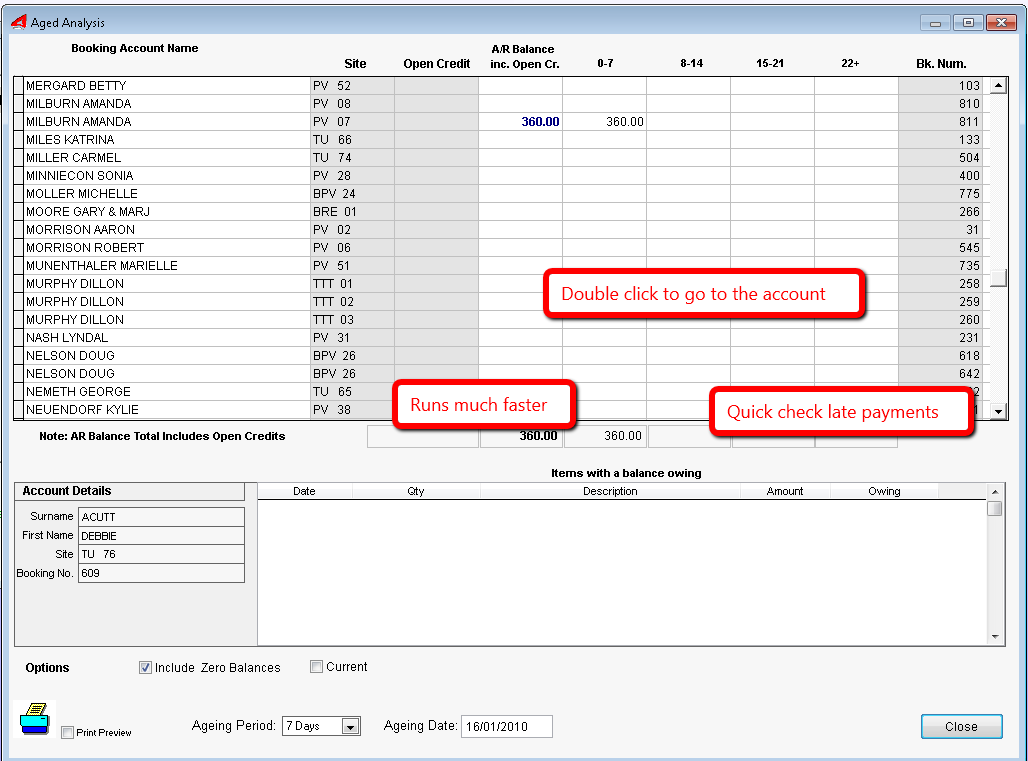

The Aged Receivables Report program shows the client balances and the "age" of ant outstanding charges in user selectable intervals of time (30,60,90 days 7,14,28 days etc)

oYou can access this report now from the Command Centre - Supervisory TAB. (As well as from the Reports Program.)

oThe report runs much faster.

oA new column show booking accounts with an Open Credit Balance (Ie. Paid more than owing)

oFast access to the Book and Bill screen for the account by double-clicking on the selected account. The Book and bill screen returns back to the Aged Analysis when you have completed the account inquiry, so you can carry on and check the next account etc.

View Example

To Launch..

Command Centre - Supervisory - Aged Receivables Report

or Menu Bar - Reports - Aged Analysis Report

This is a specialised report commonly used in parks with long term tenants where transactions are posted in advance of payment. This report shows how old a transaction posting is and groups the posted amounts into aging periods of 7 days, 14 days or 30 days. You can also use this report to correct any Balance Forward and direct access to the Charges System is possible.

The Total Column shows the totals of the periods in the Green, Yellow, Orange and Red columns.

Inc Zero Tick Box

Normally only accounts with a balance are shown. Place a Tick in the box (click on it) to show all bookings (accounts).

Access the Charges Program

When a customer line is highlighted, the transactions are previewed in the lower right display area.

You can double-click on a customer line to go directly to charges. The cursor will change to an hourglass when you can double-click.

Ageing Date

The ageing date is important as the age of the transaction is calculated from the ageing date you supply. The ageing date defaults to todays date. Right Click on the Ageing Date field to bring up a selection calendar or just type in a date.

Ageing Period

Select different ageing periods to suit you requirements. Options are: 7 days, 14 days or 30 days from the ageing date.

Re-Age Account

If the account balance (the Total column) does not agree with transaction total columns for the periods, click on the Re-Age account button. The account will be checked for consistency and the balance adjusted. The balance might differ if you have had a problem with your data or an unexpected power outage, otherwise the balance should always agree with transaction aged amounts.

Print Preview / Print

To Preview on screen what a printout will look like, place a tick in this box, then click on Print. To Print the Aged Receivables Report, click on Print.

Customize

This is a special report form editor screen and should only be used by UniRes Support or a Manager with sufficient computer experience.

Created with the Personal Edition of HelpNDoc: Easily create iPhone documentation