You will see this style of data entry in all professionally written accounting software.

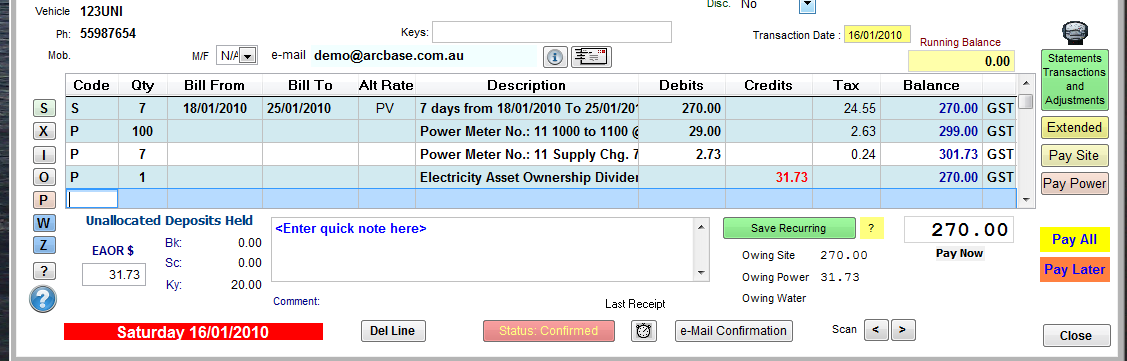

Running balance is the sum of the stored charges and payments and is added to the Balance column..

Data entry starts at the left (the Code Column) and flows through to the right of each line. Calculations are automatic.

Ten columns and fifty sales lines are available (more than adequate).

When the sale item lines reach the bottom of the line window, the window will scroll up.

Use you keyboard UP and DOWN keys to move between lines.

Press the Enter Key to move between columns and complete the whole line.

(Stopping halfway through may not complete the line calculation!)

Start charging for an item by pressing a keyboard letter key.

Press the F2 key at the top of your keyboard to see a quick help reminder screen.

The value you enter here is related to the type of charge action you have selected in the Code Column.

Site Fees: |

The Qty is the number of days if the key code was S for site fees. |

Extra Persons: |

The Qty is the number of Adults/Children/Persons if the key code was X for extra persons |

Extras Sale: |

The Qty is the number of items being sold if the key code was I for extras sales. |

Paid To Column

This column is used for site fees only. If you enter a date here, the Qty column (number of days being paid for) is calculated for you, otherwise if the Number of days is entered the Paid To column date value is set for you.

The Paid-To date in the Paid To column is the last paid-to date of the booking (or last Site fee charge) plus the number of days being paid for in this charge line Qty column.

UniRes maintains the Paid-To date of the booking for you.

Alt Rate Column

Normally you would just press enter here.

Used when charging for Site Fees. If an alternate site type code is entered here, then the charging rates for that site type is used as set in the Site Rates File maintenance.

Note that a default alternate rate can be set in the Extended Booking Details area of the charges window. This is handy if you want to temporarily set an alternate rate for a while. Click on the "small face and pencil" button to access the Extended booking details. This button is located to the right of the line entry area.

Description Column

Just about all transaction descriptions are generated by UniRes or come from other tables in UniRes. You can accept the description by just pressing enter or you can change it.

Debits Column

This is the inclusive tax charge for the transaction as a whole amount. You can override the charge by keying in new value.

Tip: A positive charge is a Debit and a negative charge is a credit. If you were to enter say - 10.00, then the negative charge (credit) will pop into the credit column. A negative charge is a refund or correction and reduces the balance owing. If you want to enter a credit, place a zero amount in this column and enter the value in the credit column as a whole number (not preceded by a -ve sign).

Credits Column

If you are refunding a charge, place the whole value (no -ve sign) in the credit column, leaving the debit column at zero. A credit amount will reduce the overall balance total.

Tip: If you want to credit site fees and reduce th paid-to date, just enter a -ve value in the Qty Column. UniRes will then calculate a credit value for you properly and a credit tax amount.

Tax Column

If tax is applicable, the amount of tax is calculated for you. The tax column can not be edited.

Balance Column

This is the running balance of the charge session. It includes any Balance Forward as shown at the top of the column.

Cd Column

This is the Tax code used for the transaction line. This code is usually one of the following.

GST = Normal Goods and Services Tax at the percent value in the GST Tax Rates program.

CSN = Concessional Tax. This is currently 5.5% (or as set in the GST Tax Rates program). Note that this is a dual tax type and the Tax code is the method of calculating tax. Part of the CSN method may be normal GST (first 27 days).

You can not alter the tax code in this column. It must be set in the appropriate File Maintenance program for the transaction type.

Del Line Button

To remove a transaction line from the charges line entry area …

Place the cursor in the line to be removed.

Click on the Del Line button.

See also the charge code Z key which clears all transactions in the line entry area.

Tax Subtotal

This is the subtotal of the tax column.

Special Note: UniRes stores tax values as floating point values. Many decimal places of precision are used. The charges program adds up the tax column in high precision and then rounds the result to 2 decimal places. This gives the most accurate GST values possible, avoiding the problems other accounting systems have with balancing the GST. The GST report is very accurate.

Some times a customer will check their receipt and do their own tax verification and say that they get a 1 cent difference in tax. This is caused by their method of rounding which is less accurate. If you frequently work with percentages, you will know what is meant.

Balance Forward Value

The balance forward value above the Balance column shows how much is still outstanding on the account. A -ve value means the site is in credit (does not include deposits held).

Balance Owing Total

This is the total amount the customer owes to their account. It includes any balance forward amounts.

A part payment can be taken. Use the A,T,G or N charge code keys to finalise a charge and take a payment.

See also Charge Code Keys .

An Invoicing System is used to provide clients with a Tax Invoice for goods or services provided. A receipt is posted or collected by the client from the vendor.

Tax Statement/Invoices can be produced for the Master Account (Tax Statement showing outstanding Invoices for all booking orders linked to a Master Account),

Tax Statement/Invoices can be produced for the Booking Account (Tax Statement showing outstanding Items for all booking orders linked to a Master Account),

Advantages of using an Invoicing System

Payments can applied selectively to a group of related charges - ie. Pay only selected Invoice.

•Site related charges

•Power usage related charges

•Water usage related charges

More you can do ...

•Debtors Master - New Bookings can create a new Debtor Account or just a Cash Account without a Master Account (Like the usual UniRes Cash system you are used to).

•Automatic Invoice Type detection and creation

•Selective one button payment for Site, Power, Water or All open invoices.

•Payment Disbursement file keeps track of which payment was paid againg which outstanding Invoice.

•Consolidated Tax Invoice Statement for multiple Account - Booking Invoices.

•Auto linking of Group Booking s to Master Accounts for consolidated billing.

•Works as a Main or Main - Sub account system.

•Same easy work flow without having extensive training.

•Can still just work as a Cash Account system just as before.

•Much easier to balance accounts at month end.

•New Account Inquiry screens, Statement forms, Tax Invoice Forms - Print or Email as before.

•Aged analysis on invoice basis.

Existing bookings can retained as cash accounts without change and later converted to a Master Account is required on a booking by booking basis.

Upon upgrading, you can choose to have UniRes convert all bookings to Master Accounts. The existing transactions would then be imported into a single "Open Invoice". Subsequent transactions would produces invoices for selective payments (Site/Power and Water Invoices where required).

A Debtors Master file is is the hub of a Debtors system. Its basically a file with a Customer (Account) number, Name and address etc. of the account holder (Company Business or Individual).

Bookings (Reservations) are really Orders for goods and services with date information and reservation checking etc.

What's so special?

The Booking can be just in the name of principal site occupier and linked (created) as a Cash Account, where the UniRes system just works as it did before upgrading, or the booking can be linked to a Master account with their own account number (The booking number is still just that, for tracking bookings).

Multiple bookings for the same or different occupiers can easily be linked as orders under the same Master Account number. Payments.

The capability of UniRes is enhansed with little change to the familiar way you worked before as a Book and Bill system. Sound hard? No, its simplicity.

After creation of invoices, you can easily selectively pay an Invoice Type using the new buttons on the screen.

=============

Created with the Personal Edition of HelpNDoc: Free help authoring environment