It may be necessary to consult your local "Rental Bonds Authority" who will hold the tenancy agreement and Bond amounts in their trust account for the tenancy with your establishment, just like the local Real Estate Rental offices in your area.

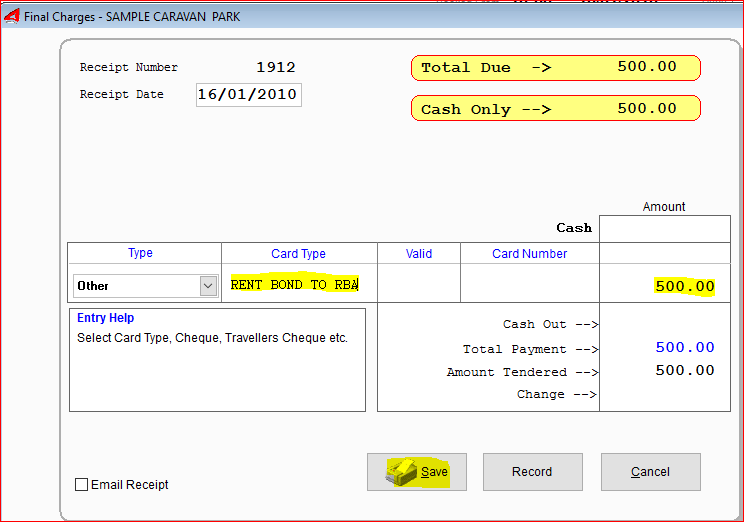

The Booking or Security deposit must still be recorded to the account and a receipt generated. This receipt should be retained by you if the bond amount is paid directly to the "Rental Bond Authority" by the tenant.

The amount is not taxed as part of your income, but your banking will reflect the amount and the cash receipts report should have the receipt or note attached for the transaction for reference.

When the tenant moves out and all is well, the Security Deposit should be refunded out of UniRes when advice is received from your RBA that the bond has been refunded to the tenant directly.

If part or all of the Bond is retained, an extras code should be used to describe the retention reason and charged to thje account. The Part of the deposit is applied as a credit to the account to counter the charge for the retention.

Retal Bond Example screen shots...

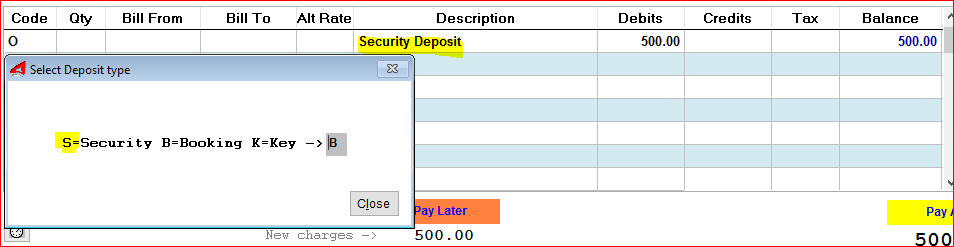

Take a Bond ...

Then Pres "A' or click on Pay ... process the payment.

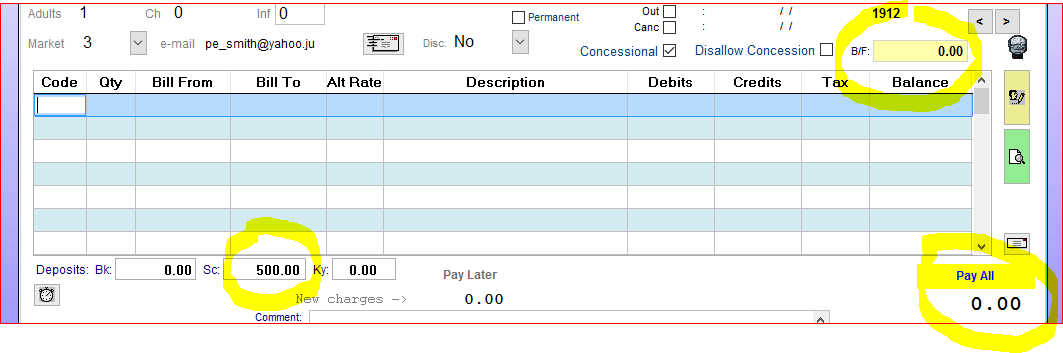

The booking account now shows $500 in the Security Deposit Held field and the running balance is zero.

This way you have a record of the transaction and the deposit is "held" so other charges will not diminish the deposit

until you "apply" the deposit as a credit, which reduces the total held accordingly.

Now what if part of the deposit is retained ?

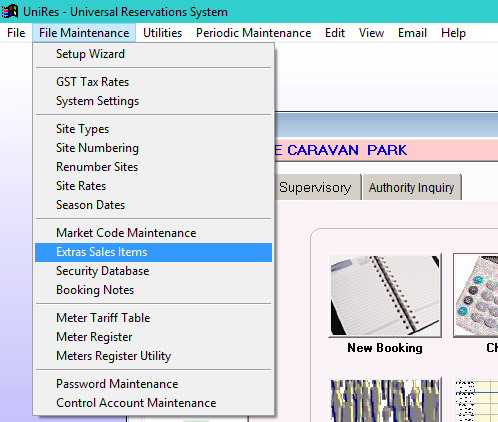

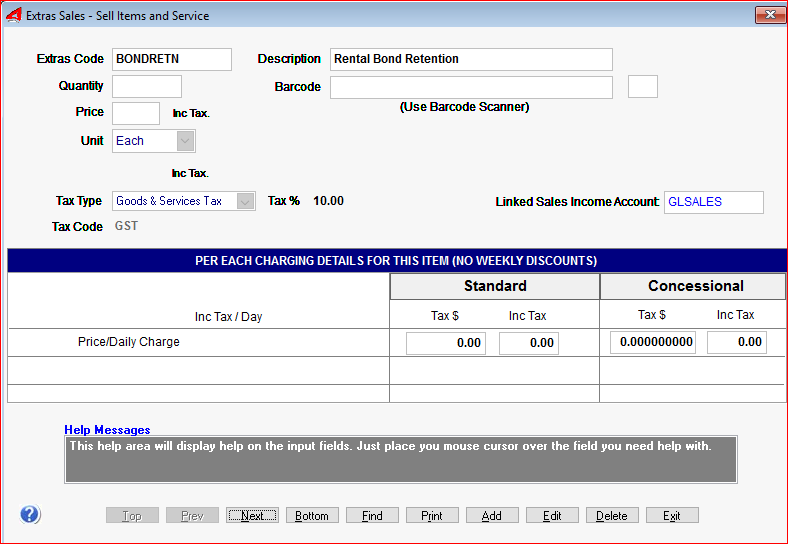

Use the "File Maintenance" - "Extras Sales Items" item you will have added to the sales items list.

This only needs to be setup once when you setup UniRes.

Example: Use a code and description meaningful to you.

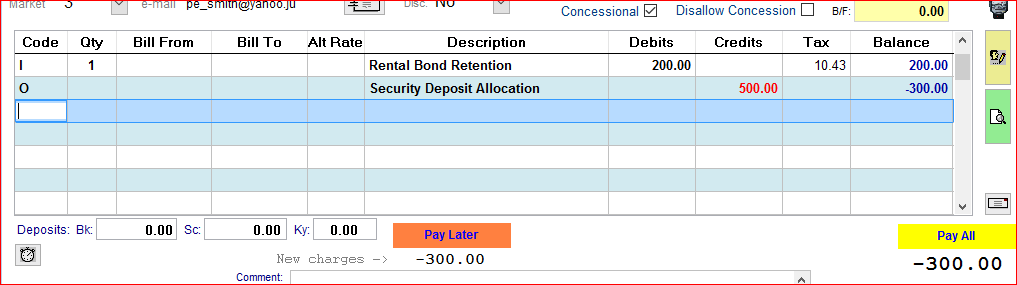

Now when you go to record the fact that you have received a retention amount (cheque or monies) from your "Rental Bond Authority", you can post the retention as a charge to the client (ex-tenant) and apply the security deposit to the outstandings.

Go to the payments screen, and you should see a -ve amount for the deposit in the Cash or Other payment fields, indicating that if you proceed, the amount is refunded.

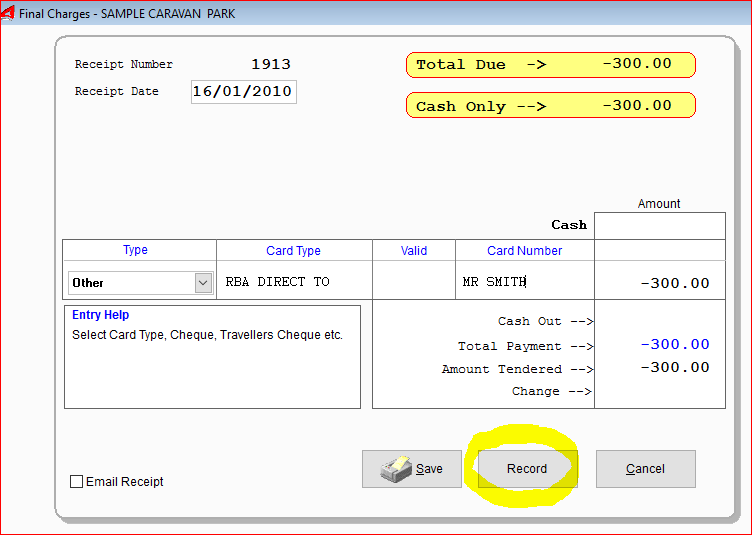

NOT THAT YOU DO NOT GIVE THE CASH TO THE TENANT AS THEY HAVE ALREADY BEEN PAID BY THE RBA!

You only record it to balance the account.

Example: Payment Clearing

Created with the Personal Edition of HelpNDoc: Free EBook and documentation generator